The insurance industry, once a bastion of traditional practices, is undergoing a seismic shift. Fueled by technological advancements and evolving consumer expectations, the future of insurance promises a landscape that is both innovative and customer-centric.

The Digital Disruption

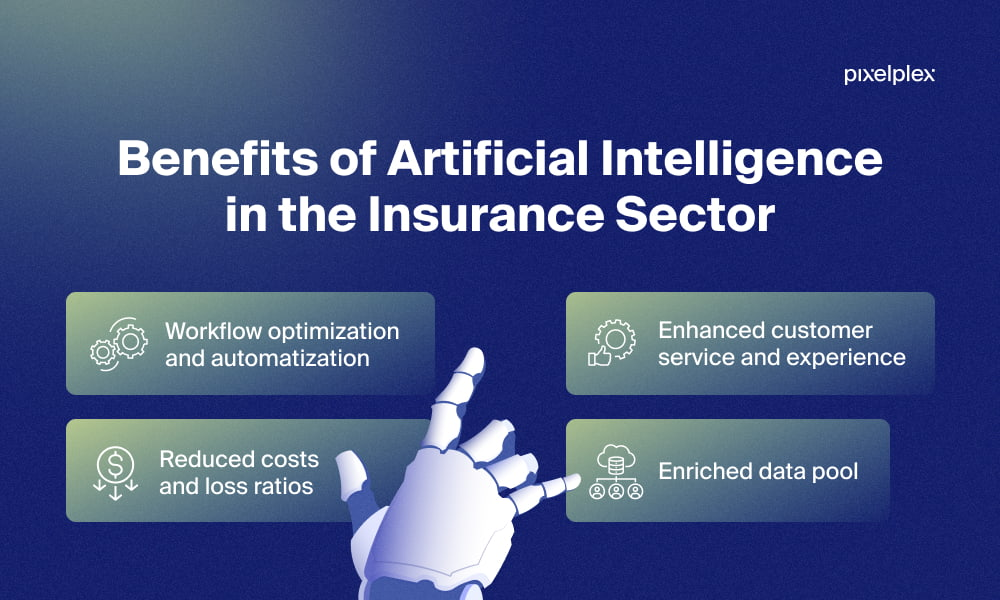

- AI-Powered Underwriting and Claims Processing: Artificial intelligence is revolutionizing the way insurers assess risk and process claims. AI algorithms can analyze vast amounts of data to identify patterns and anomalies, leading to more accurate and efficient underwriting decisions. Additionally, AI-powered chatbots and virtual assistants can streamline the claims process, providing instant support to policyholders.

- Blockchain and Smart Contracts: Blockchain technology offers a secure and transparent way to record and verify transactions. Smart contracts, self-executing contracts with the terms of the agreement directly written into code, can automate insurance processes, reducing administrative costs and eliminating the need for intermediaries.

- IoT and Predictive Analytics: The Internet of Things (IoT) enables insurers to collect real-time data from connected devices, such as wearable fitness trackers and smart home systems. This data can be used to assess risk more accurately and offer personalized insurance products. Predictive analytics, powered by machine learning, can analyze historical data to identify potential risks and proactively take preventive measures.

The Rise of Insurtech

Insurtech startups are disrupting the traditional insurance model by offering innovative products and services. These startups leverage technology to provide more flexible, affordable, and customer-centric insurance solutions. Some key trends in Insurtech include:

- Microinsurance: Microinsurance provides affordable coverage for low-income individuals and small businesses. Insurtech companies are using technology to reach underserved populations and offer tailored insurance products.

- On-Demand Insurance: On-demand insurance allows customers to purchase coverage for specific periods or situations, such as renting a car or a bike. This flexible approach can reduce costs and provide greater convenience.

- Peer-to-Peer Insurance: Peer-to-peer insurance models allow individuals to pool their risks and share the cost of insurance. This can lead to lower premiums and more personalized coverage.

Redefining the Customer Experience

The future of insurance is centered around the customer experience. Insurers must adapt to changing consumer expectations and provide seamless, personalized, and digital-first experiences. Key strategies include:

- Personalized Insurance: By analyzing customer data, insurers can offer tailored products and services that meet individual needs. This can lead to higher customer satisfaction and loyalty.

- Omnichannel Customer Support: Insurers must provide consistent and efficient support across multiple channels, including mobile apps, websites, and social media.

- Data Privacy and Security: As insurers collect and store more personal data, it is crucial to prioritize data privacy and security. Implementing robust cybersecurity measures is essential to protect customer information.

The Impact of Climate Change

Climate change is a significant risk factor that is reshaping the insurance industry. Insurers must adapt to the increasing frequency and severity of natural disasters, such as floods, wildfires, and hurricanes. Key strategies include:

- Climate Risk Modeling: Advanced climate models can help insurers assess the impact of climate change on specific regions and industries.

- Green Insurance Products: Insurers can offer products that incentivize sustainable practices, such as discounts for energy-efficient homes or electric vehicles.

- Climate Resilience Strategies: By partnering with governments and businesses, insurers can develop strategies to build resilience to climate change.

Conclusion

The future of insurance is bright, but it requires significant transformation. By embracing technology, innovation, and customer-centricity, insurers can navigate the challenges and opportunities of the 21st century. As the industry continues to evolve, it is essential to prioritize ethical considerations, social responsibility, and long-term sustainability.