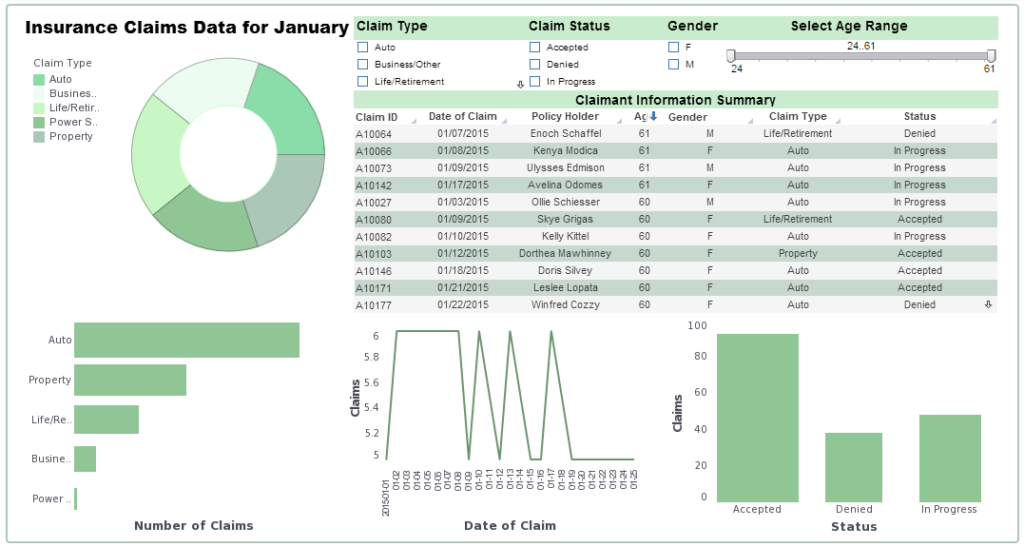

The insurance industry is a complex and dynamic sector that requires careful strategic planning to succeed. In today’s competitive market, insurance companies must adopt innovative strategies to attract and retain customers, manage risks effectively, and optimize their operations. This article delves into key insurance strategy analysis areas and provides insights into how companies can develop and implement successful strategies.

Understanding the Insurance Landscape

The insurance landscape is characterized by several key trends that are shaping the industry:

- Digital Transformation: The increasing adoption of digital technologies is revolutionizing the way insurance companies operate. From online customer portals to AI-powered claims processing, digital transformation is driving efficiency and improving customer experience.

- Emerging Risks: Climate change, cyber threats, and geopolitical uncertainties are creating new and complex risks that insurers must address. This necessitates a proactive approach to risk assessment and management.

- Regulatory Changes: The regulatory environment for insurance is constantly evolving, with new regulations impacting everything from product design to pricing. Staying abreast of regulatory changes is crucial for compliance and risk mitigation.

- Customer Expectations: Today’s customers expect personalized experiences, seamless interactions, and quick claim resolutions. Insurance companies must adapt their offerings to meet these evolving expectations.

Key Areas of Insurance Strategy Analysis

- Customer Segmentation and Targeting:

- Identify Customer Segments: Divide the customer base into distinct groups based on demographics, behaviors, and needs.

- Tailor Product Offerings: Develop customized insurance products that address the specific needs of each segment.

- Implement Targeted Marketing: Utilize data-driven marketing strategies to reach the right customers with the right message.

- Risk Management and Pricing:

- Advanced Risk Assessment: Employ sophisticated analytical tools to assess and quantify risks accurately.

- Dynamic Pricing Models: Implement flexible