Introduction

The insurance industry, a sector rooted in trust and transparency, is ripe for disruption. Blockchain technology, with its decentralized and immutable nature, offers a promising solution to many of the industry’s long-standing challenges. This article explores the potential of blockchain to revolutionize insurance operations, enhance security, and improve customer experience.

Understanding Blockchain Technology

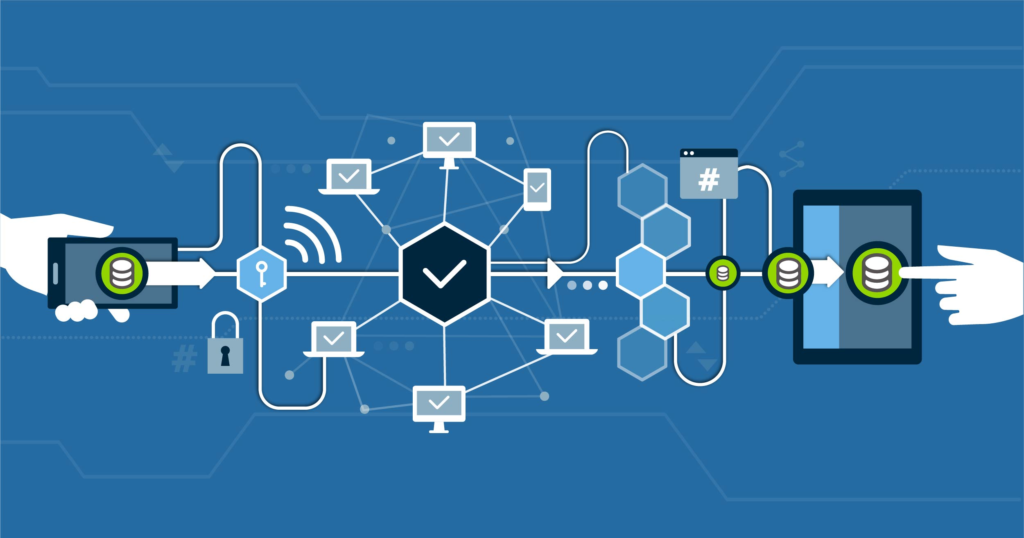

Blockchain is a distributed ledger technology that records transactions across multiple computers. It is characterized by the following key features:

- Decentralization: No single entity controls the network.

- Immutability: Once data is recorded, it cannot be altered.

- Transparency: All transactions are visible to all participants.

- Security: Cryptographic techniques ensure the security of the network.

Blockchain’s Impact on Insurance

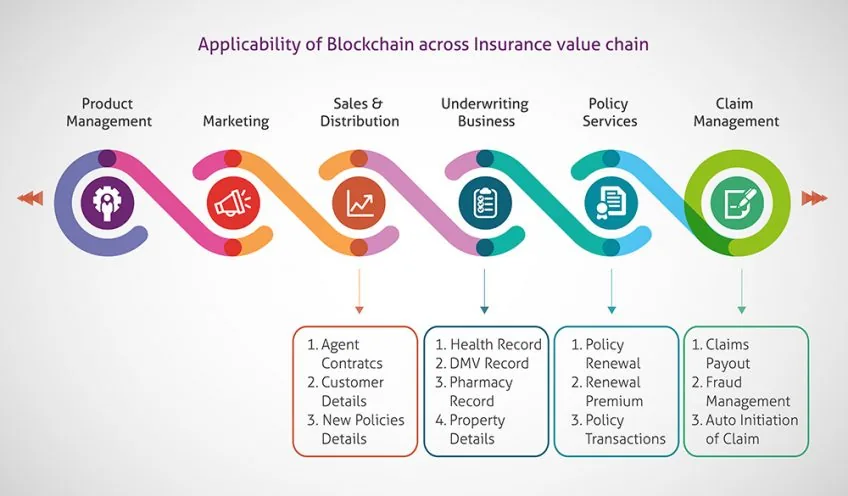

Blockchain technology can be applied to various aspects of the insurance industry, including:

1. Smart Contracts:

- Automated Claims Processing: Smart contracts can automate the claims process, reducing processing time and minimizing human error.

- Risk Assessment and Underwriting: By analyzing data from various sources, smart contracts can assess risk more accurately and efficiently.

- Policy Management: Smart contracts can automate policy issuance, renewal, and cancellation, streamlining the entire policy lifecycle.

2. Enhanced Security and Transparency:

- Secure Data Sharing: Blockchain can facilitate secure and transparent data sharing between insurers, reinsurers, and other stakeholders.

- Fraud Prevention: By tracking the entire insurance lifecycle on a blockchain, fraudsters will find it harder to manipulate data or commit fraudulent claims.

- Audit Trail: Blockchain provides an immutable audit trail, ensuring transparency and accountability.

3. Improved Customer Experience:

- Real-time Claims Processing: Smart contracts can process claims in real-time, allowing customers to receive payments faster.

- Personalized Insurance Products: Blockchain can enable insurers to offer personalized insurance products based on individual risk profiles.

- Enhanced Customer Trust: By providing transparency and security, blockchain can build trust between insurers and customers.

Challenges and Considerations

While blockchain offers significant potential, there are challenges to its adoption in the insurance industry:

- Scalability: Blockchain networks may struggle to handle large volumes of transactions, especially during peak periods.

- Regulatory Hurdles: Regulatory uncertainty and lack of clear guidelines can hinder the adoption of blockchain technology.

- Technical Complexity: Implementing blockchain solutions requires specialized technical expertise.

- Interoperability: Ensuring seamless integration with existing systems and legacy infrastructure can be challenging.

The Future of Insurance: A Blockchain-Powered Industry

Despite the challenges, the future of insurance looks promising with blockchain technology. By embracing this disruptive innovation, insurers can streamline operations, reduce costs, and enhance customer satisfaction. As the technology continues to mature, we can expect to see a wave of blockchain-powered insurance solutions that will transform the industry.

In conclusion, blockchain technology has the potential to revolutionize the insurance industry. By addressing the challenges and embracing the opportunities, insurers can unlock the full potential of this transformative technology.